Larry Long, debilitated by a stroke while using the pain medicine Vioxx, was facing eviction from his Georgia home in 2008. He could not wait for the impending settlement of a class-action lawsuit against the drug’s maker, so he borrowed $9,150 from Oasis Legal Finance, pledging to repay the Illinois company from his winnings.

By the time Long received an initial settlement payment of $27,000, just 18 months later, he owed Oasis almost the entire sum: $23,588.

Gary Tramontina/The New York Times

Ernesto Kho had pressing needs of his own. Medical bills had piled up after he was injured in a 2004 car accident. So he borrowed $10,500 from Cambridge Management Group, another company that lends money to plaintiffs in personal-injury lawsuits. Two years later, Kho, a New Jersey resident, got a $75,000 settlement — and a bill from Cambridge for $35,939.

The business of lending to plaintiffs arose over the last decade, part of a trend in which banks, hedge funds and private investors are putting money into other people’s lawsuits. But the industry, which now lends plaintiffs more than $100 million a year, remains unregulated in most states, free to ignore laws that protect people who borrow from most other kinds of lenders.

Unrestrained by laws that cap interest rates, the rates charged by lawsuit lenders often exceed 100 percent a year, according to a review by The New York Times and the Center for Public Integrity. Furthermore, companies are not required to provide clear and complete pricing information — and the details they do give are often misleading.

A growing number of lawyers, judges and regulators say that the regulatory vacuum is allowing lawsuit lenders to siphon away too much of the money won by plaintiffs.

“It takes advantage of the meek, the weak and the ignorant,” said Robert J. Genis, a personal-injury lawyer in the Bronx who said that he had warned clients against borrowing. “It is legal loan-sharking.”

Colorado filed suit in December against Oasis and LawCash, two of the largest companies, charging them with violating the state’s lending laws.

“It looks like a loan and smells like a loan and we believe that these are, in fact, high-cost loans,” John W. Suthers, the state’s attorney general, said in a recent interview. “I can see a legitimate role for it, but that doesn’t mean that they shouldn’t be subject to regulation.”

The companies, however, say that they are not lenders because plaintiffs are not required to repay the money if they lose their cases. The industry refers to the transactions as investments, advances, financing or funding. The argument has persuaded regulators in many states, including New York, that lawsuit lenders are not subject to existing lending laws. Oasis and LawCash have now filed suit against Colorado, asking the court to prevent the state from using lending laws to regulate the industry.

Companies also say that they must charge high prices because betting on lawsuits is very risky. Borrowers can lose, or win less than expected, or cases can simply drag on, delaying repayment until the profit is drained from the investment.

To fortify its position, the industry has started volunteering to be regulated — but on its own terms. The companies, and lawyers who support the industry, have lobbied state legislatures to establish rules like licensing and disclosure requirements, but also to make clear that some rules, like price caps, do not apply.

Maine and Ohio passed the first such laws in 2008, followed by Nebraska last year. Sympathetic legislators introduced bills in six other states last year; the measures passed the state Senates in New York and Illinois.

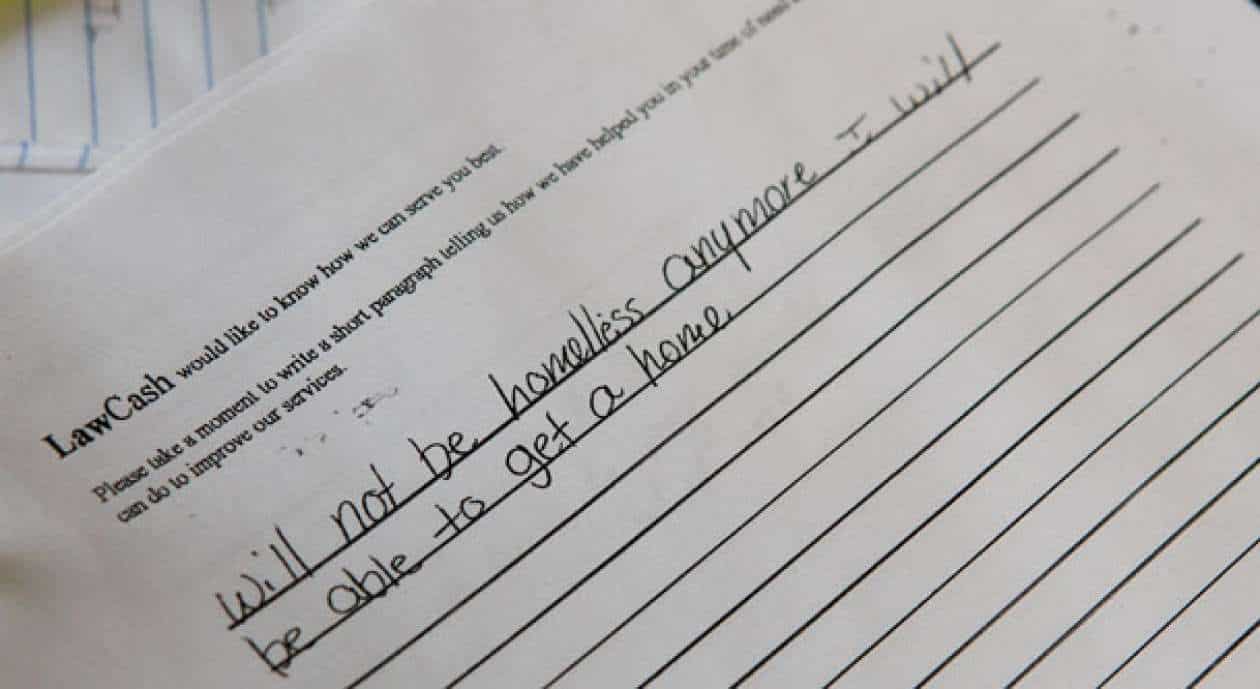

Harvey Hirschfeld, a founder of LawCash who keeps binders filled with thank-you notes from borrowers on a shelf in his Brooklyn office, said lawmakers have responded to the needs of plaintiffs.

“Sometimes people are in the wrong place at the wrong time, they get in an accident, they’re out of work, they don’t have cash sitting in the bank, their friends can’t help, and they’re faced with a terrible situation,” said Hirschfeld, who also is chairman of the industry’s trade group. “It’s not for everyone, but it’s there when you need it.”

High rates, low risk

Harvey Hirschfeld is a co-founder of LawCash, a company that lends money to people who want to pursue lawsuits. Credit Ruth Fremson, The New York TimesThere was little risk in lending money to Larry Long. The drug’s maker, Merck, already had agreed to settle the Vioxx class action. The projected payouts were relatively easy to calculate: Long’s lawyer estimated that he would eventually get a total of about $80,000.

Oasis still imposed its standard pricing: 50 percent of the loan amount if repayment was made within six months, with regular increases thereafter.

Long and his wife resented the high cost, but they had run through their savings. Long was legally blind and needed regular dialysis. His wife, Deborah, had left work to care for him. They borrowed $3,000 in February 2008, $3,000 in March and $3,150 in July.

“We were having a crisis, and they knew we were having a crisis,” Long said. “They take advantage of people that are in need.”

Oasis made loans on similar terms to 43 Vioxx plaintiffs, totaling about $224,000.

Orran L. Brown, the Virginia lawyer appointed to disburse the settlement, described the cost of the loans as “unconscionable.”

“There was very little risk of nonrecovery, but they were charging full freight,” he said.

But Gary Chodes, the company’s chief executive, said the performance of the Vioxx loans showed why Oasis must charge high rates. Eight of the 43 borrowers failed to qualify for the settlement, he said, and an additional seven did not win enough to pay the full amount that they owed.

The company waived its claim against the Longs after the couple complained to the federal judge overseeing the Vioxx case. Chodes said that Oasis acted out of compassion for the couple’s personal difficulties, but that the company had done nothing wrong. The Longs asked for money and Oasis clearly explained its terms, Chodes said. He provided copies of documents on which Long had recorded his thanks for the loans.

“We were there when he needed help with his house note and his car note and his medical bills. And he was plenty grateful at the time,” Chodes said.

Lenders more often invest in cases even earlier in the process, before a settlement is on the table.

James N. Giordano, chief executive of Cambridge Management Group, a New Jersey lender, compared the deals to venture capital. “It’s as if your buddy came up to you and said, ‘I’m starting a business, I need $25,000 — and, by the way, you may never get your money back,’” he said.

Lawsuit lenders, however, are much better than venture firms at picking winners. Lenders pay lawyers to screen cases, looking for slam-dunks like Vioxx. Three of the largest companies each estimated that they rejected about 70 percent of applications. Oasis said it had approved about 80,000 of 250,000 applications in recent years. To further limit losses, companies say they generally lend no more than 10 or 20 percent of the amount they expect the borrower to win.

Companies say they still lose money in a significant share of cases, from 5 to 20 percent, although there is no way to verify those numbers.

But courts in several states — including Michigan, New York and North Carolina — have ruled in recent years that individual borrowers did not need to repay lawsuit loans, finding that the apparent risks did not justify the outsize prices. The rulings have encouraged lenders to avoid judicial scrutiny. Dimitri Mishiev, who runs Alliance Claim Funding, another Brooklyn lender, said that while his prices were fair, he tried to invest only in cases he expected to be settled before trial.

“Everything that might have to go before a judge, you stay away because you don’t want the judge to be in the position of saying, ‘I don’t want that level of payment. I think it’s unreasonable,’” Mishiev said. “We don’t want judges to shine a light on us.”

Truth in lending

Lawsuit lenders do not advertise prices; they advertise convenience. They send letters to people who file lawsuits, and run ads on daytime and late-night television, emphasizing that money is available quickly and easily.

Carolyn and James Williams at their home in Alabama. Carolyn Williams borrowed $5,000 to pursue a disability lawsuit; she now owes $18,976 and her case is unresolved. Credit: Gary Tramontina, The New York TimesWhen David Kert, a personal-injury lawyer, took a job in 2007 screening applicants for the lender Whitehaven Plaintiff Funding in New York City, he said that he was told not to mention the cost of the loans unless he was asked directly.

Kert spent the next year answering 50 to 60 calls each workday from plaintiffs and their lawyers. He said many of those people ended up taking loans from Whitehaven without ever asking the price — as high as 99 percent of the loan amount in the first year.

“I’m sorry I spent any time there,” Kert said recently.

Whitehaven did not return calls for comment, but other industry executives are quick to note that borrowers are consenting adults. Furthermore, under the terms of a 2005 agreement between the largest lenders and the New York attorney general’s office, borrowers must be given a table showing what they will owe at six-month intervals. The agreement also requires lenders to obtain the signed consent of the borrower’s lawyer.

“I don’t know any other industry that is as clear as that. Everything is written on the contract and the attorney is reviewing it for you,” Hirschfeld said.

But these safeguards are significantly less strict than the requirements that state and federal laws impose on other consumer lenders. They do not dictate how interest rates should be calculated, for example, making it difficult for borrowers to compare prices.

Moreover, outside of New York and the few states that regulate the industry, lenders are not required to follow those procedures — and in several cases examined by The Times and the Center for Public Integrity, they did not do so.

Carolyn Williams borrowed $5,000 in 2007 from USClaims, a Delaware lender, while pursuing a disability lawsuit against her former employer, an Alabama nursing home. Three years later, her case is unresolved. Her debt stands at $18,976.

Williams, who left her nursing job after experiencing a debilitating asthma attack, contacted USClaims after seeing an ad on late-night television. She was struggling to pay her bills and her case, which argues that the asthma had been caused by exposure to floor cleaning chemicals, was moving slowly. Two days after she called USClaims, the company wired $5,000 to her bank account.

Williams said she did not ask about the cost of the loan and she was not told. Her lawyer, Timothy Hughes, said he was not contacted by USClaims until after the loan was made. The contract Williams signed quoted an annual interest rate of 39 percent, compounded monthly. In fact, she was charged interest and fees equaling 76 percent of the loan amount in the first year.

“I was definitely misled,” Williams said recently. “I never expected that high of a rate.”

Darryl Levine, the president of Delaware-based U.S. Claims, said the contract clearly showed how much Williams would owe.

“In over 14 years in this business, I have never had any complaint about the rate of return disclosure,” Levine said.

Seeking the mainstream

The industry’s pursuit of regulation on its own terms began in Maine in 2007.

Sharon Anglin Treat, a lawyer and state legislator, had proposed a bill making clear that lawsuit lenders were subject to state consumer protection laws. She said she could not understand why the industry should be allowed to charge higher rates than other lenders.

Oasis, LawCash and other companies persuaded other legislators to reverse the intent of the bill, instead making clear that the rules did not apply to lawsuit loans. Both Treat and Hirschfeld said the debate turned on the testimony of three Maine residents who had benefited from the loans. “These are powerful companies that have lots of money, and they brought in people with these sob stories,” Treat said.

Supporters of lawsuit lending next turned its attention to Ohio, where the state’s Supreme Court had declared lawsuit lending illegal in 2003. This time, Hirschfeld said that the industry asked lawyers throughout the state for examples of clients who had suffered because they were not able to borrow money. Both chambers of the legislature voted unanimously in 2008 to legalize the loans.

Last year, Nebraska followed suit, passing a bill sponsored by State Senator Steve Lathrop, a trial lawyer.

“My own personal view of these groups is that I discourage clients from using them,” Lathrop said during the final debate. “I tell them, go borrow from anybody you can before you have to use them.”

“But,” he concluded, “the reality is, sometimes there’s no other place to turn.”